01

電池業界を支える人を和歌山から育てたい。

一度はものづくりを離れたこともあった池添…

はたらく人の「イキイキ」をつくり、

日本の製造業の未来をつくる。

Copyright © UT Group Co., Ltd.

All rights reserved.

SCROLL DOWN

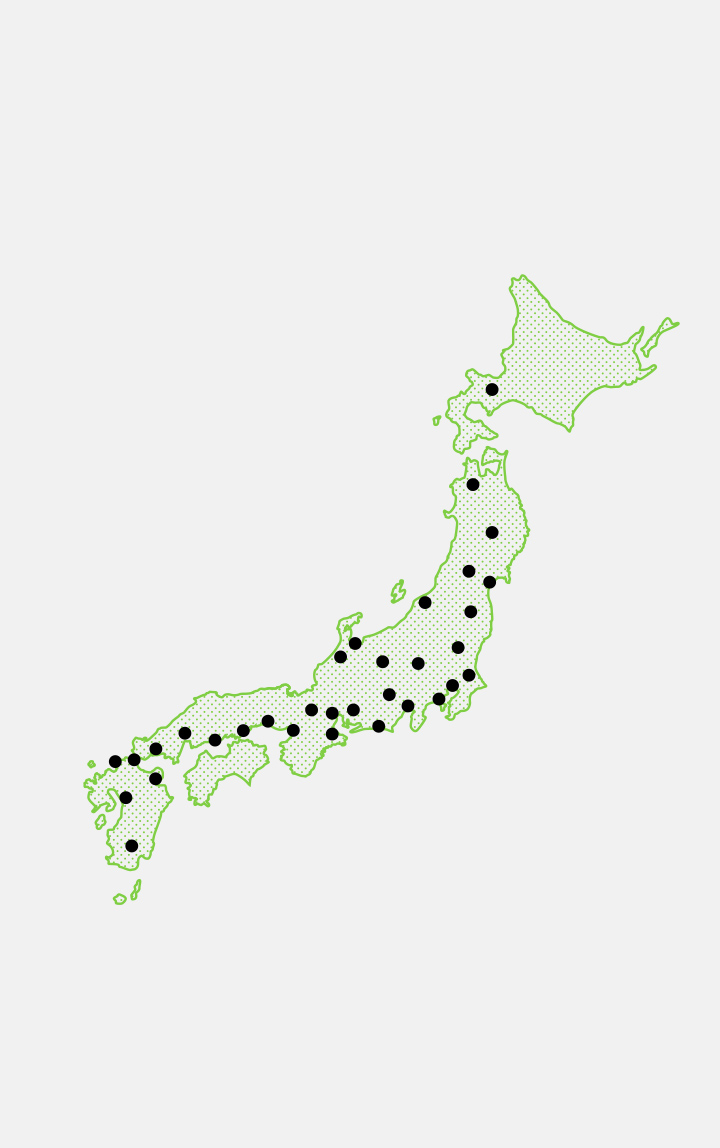

自動車産業やエレクトロニクスといった、世界を牽引する日本のものづくり。これからも成長し続ける製造業の現場を人と技術の力で支えることが、UTエイムの使命です。大規模派遣・製造請負・半導体の受託開発・外国人労働者の管理代行まで。全国各地、多様な領域で、はたらく人の「イキイキ」を生み出し続けます。

UTエイムではたらく一人ひとりの「イキイキ」の姿と、人の人生に寄り添い向き合い続けるUTグループの「現在進行形」の取り組みをお伝えします。